In this Knoxville Insider Issue…

🌤️ Real Estate Edition - Can Home Ownership Build Wealth?

❔ Answers to Reader-Submitted Real Estate Questions

Can Home Ownership Build Wealth?

Homeownership has long been considered a cornerstone of the American Dream, symbolizing stability, security, and success.

One of the primary ways homeownership builds wealth is through the accumulation of equity. Equity is the difference between the market value of a home and the outstanding balance on the mortgage. As homeowners make mortgage payments and as property values appreciate, their equity grows. Unlike renting, where monthly payments only benefit the landlord, mortgage payments increase the homeowner’s stake in their property, effectively turning a portion of their income into an asset.

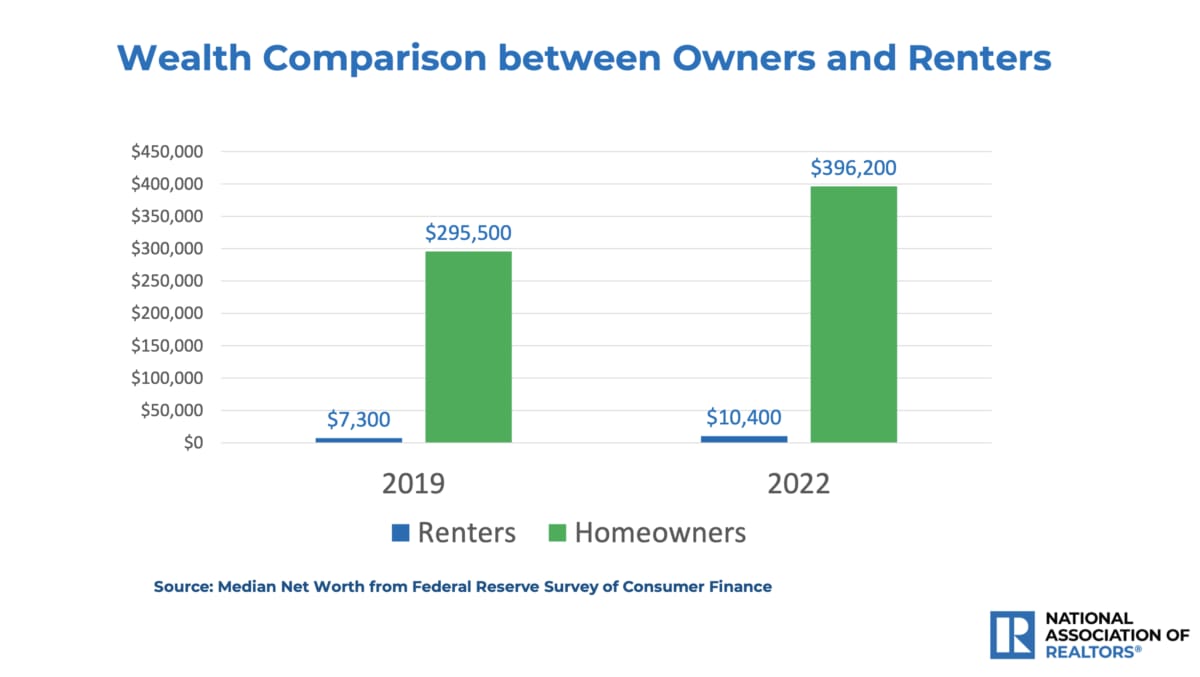

Secondly, real estate historically appreciates over time, contributing to the growth of wealth. Although markets can fluctuate, property values generally increase in the long term. This appreciation can significantly boost a homeowner’s net worth. For example, a home purchased for $200,000 may be worth $300,000 or more after a decade or two, providing a substantial return on investment. According to the Federal Reserve Survey of Consumer Finance, the median net worth of homeowners in 2022 was estimated at $396,200, while the median net worth of renters was estimated at $10,400.

Homeownership is more than just a personal milestone; it is a strategic investment that can create lasting financial benefits for individuals and their families. By building equity, benefiting from property appreciation, enjoying tax advantages, and providing stability, homeownership lays a solid foundation for generational wealth. As we work towards a more equitable society, expanding access to homeownership will be key to closing the wealth gap and fostering prosperity for all.

Homeownership is not just a symbol of the American Dream; it is a practical means of achieving long-term financial security and success. By investing in a home, individuals can secure their futures and contribute to the economic well-being of future generations.

Ask a Realtor😀

Thank you to our readers for submitting the questions below!

Question 1: When an adjacent undeveloped piece of property is being sold, will a survey be done to confirm property lines? (submitted by Karen)

A survey is not mandatory for the sale of a parcel of land. However, if the parcel needs to be divided into smaller sections, a survey will be required. That being said, getting a survey is always a wise decision to protect yourself and your property. Although opting for a survey might delay the closing process, you will have an official document that clearly defines your property lines.

This Real Estate Edition Issue brought to you by Barbara Newton

Become a Knoxville Insider Real Estate Edition Sponsor

Are you a brand new or established business looking to become known in our Knoxville Insider community? We are looking for locally-owned business that would like to become a Knoxville Insider sponsor! Sponsorships can include:

Hero or section banners

Logo

Video

Print

Spotlight Directory

and more…

Reach out to us at [email protected].